AudioEye Reports Second Quarter 2019 Results

Record Bookings Lead to Increased Full-Year Expectations; High Customer Retention Continues to Support Future Revenue Growth

Company Secures Additional Capital

TUCSON, Ariz. – August 14, 2019— AudioEye, Inc. (NASDAQ: AEYE), a leading developer of digital accessibility solutions that provide barrier-free website access for individuals with disabilities, reported financial results for the second quarter ended June 30, 2019.

Second Quarter and Recent Operational Highlights

- Continued to grow direct sales channel client roster in the second quarter with prominent new customers from the technology, fashion, retail, hospitality and healthcare space among others.

- Continued to fortify new indirect channel partner relationships. Currently, 18 established channel partners offer AudioEye as their exclusive digital accessibility solution to their clients.

- Increased the sales and implementation teams to grow AudioEye market share faster and to continue implementing its service solution for customers in a timely manner.

- Expanded relationship with Dealer.com, a Cox Automotive brand, to become the Company’s premier partner for digital accessibility in the U.S automotive industry.

- Became an official member of the World Wide Web Consortium (W3C), an international community comprised of member organizations that work closely with the public to develop high-quality standards for the web.

- Added to the Russell Microcap® Index, effective July 1, 2019.

- Selected by Arlington Public Schools as its web accessibility solution, ensuring the centralized district website, which includes all schools within its district, are accessible to individuals with disabilities.

Second Quarter 2019 Financial Results

- Bookings increased 140% to a $7.3M from $3.0M in the same year-ago period. The increase in bookings was primarily due to execution in contract closings in the direct channel and expanding contracts with an existing indirect channel partner.

- Total revenue increased 97% to a record $2.4M from $1.2M in the same period a year ago. The increase in revenue was primarily due to continued execution in the direct channel, increased growth in the indirect channel and additional contracts awarded through the Company’s PDF remediation business.

- Gross profit increased 110% to $1.3M (~53% of total revenue) from $612K (~50% of total revenue) in the same year-ago period. The increase in gross profit and gross margin was primarily due to increased sales volume and an increasing revenue renewal rate with longer contract terms.

- Total operating expenses increased 94% to $3.3M from $1.7M in the same year-ago period. The increase in total operating expenses was primarily due to continued investment in the Company’s growth through technology enhancements, consulting, legal and compliance costs, as well as recruiting, marketing, and other key personnel costs.

- Net loss available to common stockholders was $2.0M, or $(0.27) per share, compared to $1.1M, or $(0.17) per share, in the same year-ago period. The greater net loss was primarily due to increased expenses in a number of key areas as the Company continues to position itself for its multi-year growth plan.

- At quarter-end, the Company had $2.8M in cash, compared to $5.7M at December 31, 2018, and no debt.

- Deferred revenue increased 87% to $3.2M from $1.7M in the second quarter of 2018.

- Contracts in excess of revenue and deferred revenue increased 152% to $13.7M from $5.5M in the same period last year.

- As of June 30, 2019, total customer count had grown to over 1,400 customers.

- As of June 30, 2019, monthly recurring revenue (MRR) totaled $774K which was an increase of 13% compared to $686K at March 31, 2019.

Full Year 2019 Financial Outlook

The Company is increasing its full year bookings guidance to $22M to $24M. The Company now expects revenue for the full year to range between $10.0M and $11.0M. With increased PR and marketing efforts, additional hires in the sales and installation teams, and further emphasis on the development of technological enhancements, momentum is expected to increase the pace of both bookings and revenue throughout the balance of the year.

Subsequent Event

In August 2019, certain of the Company’s outstanding warrants were amended to provide for a reduction in exercise price through August 16, 2019, provided the amended warrants were exercised in full and the exercise price was paid in cash. Expected cash proceeds from the exercise of these warrants is approximately $2M. Additionally, in August 2019, the Company secured a $2M Line of Credit.

Management Commentary

AudioEye Executive Chairman Carr Bettis said, “With the results of last quarter providing a strong base for the start of 2019, we took another big step forward in Q2. Bookings and revenue were, again, record performances with the bookings increasing 141% and revenue growing 96%, both compared to the second quarter of last year. We’ve now achieved growth in topline for the fourteenth consecutive quarter, which is a testament to our value proposition coupled with sales execution within both our direct and indirect channels as well as our new markets such as PDF remediation. Looking to the remainder of the year, we are continuing to retain existing customers on longer contract renewals, which resulted in our record bookings performance as well as an increase in full-year bookings guidance. These longer commitments from our customers allow us to create more predictability in our future revenue streams so that we can more proactively plan for the future. We’ve also adjusted revenue expectations for the year due to slower than expected partner program ramp-up. However, we are continuing to refine that part of our go-to-market strategy with a heightened focus on quality of partnership, partner resources to improve program adoption and getting long-term commitments. Going forward, we’re going to continue investing and allocating resources that will help us scale and grow further in 2020 and beyond.”

AudioEye CEO Todd Bankofier added: “In the second quarter, we continued to win new business with companies of all sizes through our various channels, and we’re doing so at an accelerated rate. More specifically, we currently count over 1,400 total customers as users of our Ally Managed Service offering, having signed on over 300 new accounts in just the last quarter. Our ongoing public relations and marketing efforts have also provided greater awareness for our solutions, which is now translating into increased leads and the greatest pipeline in our company’s history. Through the recent expansion of our relationship with Dealer.com into a premier partnership, we now have an even stronger commitment from the largest CMS provider in the auto industry through Cox Automotive. AudioEye is in a truly unique position as the gold-standard, technology leader in a nascent market that we believe will expand tremendously in the coming years.”

Conference Call

AudioEye management will hold a conference call today, August 14, 2019 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

AudioEye management will host the call, followed by a question and answer period.

U.S. dial-in number: (877) 407-9208

International number: (201) 493-6784

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at (949) 574-3860.

The conference call will also be webcast live and available for replay, which will be accessible via the investor relations section of the company�’s website. An audio recording will remain available via the investor relations section of the company’s website for 90 days.

A telephonic replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 21, 2019.

Toll-free replay number: (844) 512-2921

International replay number: (412) 317-6671

Replay ID: 13692898

About AudioEye, Inc.

AudioEye is a technology company serving businesses committed to providing equal access to their digital content. Through patented technology, subject matter expertise and proprietary processes, AudioEye is transforming how the world experiences digital content. Leading with technology, AudioEye identifies and resolves issues of accessibility and enhances the user experience, making digital content more accessible and more usable for more people.

AudioEye’s common stock trades on the Nasdaq Capital Market under the symbol “AEYE.” The Company maintains offices in Tucson, Scottsdale, Atlanta, New York and Washington D.C. For more information about AudioEye and its online accessibility solutions, please visit www.audioeye.com.

Forward-Looking Statements

Any statements in this press release about AudioEye’s expectations, beliefs, plans, objectives, prospects, financial condition, assumptions or future events or performance are not historical facts and are “forward-looking statements” as that term is defined under the federal securities laws. Forward-looking statements are often, but not always, made through the use of words or phrases such as “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, “outlook” and similar words. You should read the statements that contain these types of words carefully. Such forward-looking statements contained herein include, but are not limited to, statements regarding continued rapid expansion in 2019 and beyond and long-term growth opportunities, revenue and bookings for the year ending December 31, 2019, the acceleration of public relations and marketing efforts to increase the Company’s pipeline, and the use of financial resources and the addition of personnel to build on the Company’s market position. These statements are subject to a number of risks, uncertainties and other factors that could cause actual results to differ materially from what is expressed or implied in such forward-looking statements, including the variability of AudioEye’s revenue and financial performance; risks associated with product development and technological changes; the acceptance of AudioEye’s products in the marketplace by existing and potential future customers; competition; and general economic conditions. These and other risks are described more fully in AudioEye’s filings with the Securities and Exchange Commission (the “SEC”), including AudioEye’s Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on March 27, 2019. There may be events in the future that AudioEye is not able to predict accurately or over which AudioEye has no control. Forward-looking statements reflect management’s view as of the date of this press release, and AudioEye urges you not to place undue reliance on these forward-looking statements. AudioEye does not undertake any obligation to update such forward-looking statements to reflect events or uncertainties after the date hereof.

About Key Operating Metrics

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (GAAP), we consider certain operating measures that are not GAAP measures, including monthly recurring revenue, bookings and contracts. AudioEye reviews a number of operating metrics such as these to evaluate its business, measure performance, identify trends, formulate business plans, and make strategic decisions. We believe these metrics and measures are useful to facilitate period-to-period comparisons of our business and to facilitate comparisons of our performance to that of other similar companies. In this press release, we are reporting results and/or updating our previously announced guidance on bookings, revenue and monthly recurring revenue.

AudioEye’s bookings represents the contracted amount of money the customer commits to spend with the Company over an agreed amount of time, generally ranging from 12 months up to 60 months.

AudioEye’s contracts in excess of revenue and deferred revenue is the remaining bookings that have not yet been recognized as revenue or billed to the customer. This measure represents the contractually agreed amount of money that is remaining to be billed and paid under contracts and that will be recognized in subsequent periods.

AudioEye’s monthly recurring revenue is the Company’s annualized spend of a customer divided by 12.

Corporate Contact:

AudioEye, Inc.

Todd Bankofier, Chief Executive Officer

tbankofier@audioeye.com

(520) 308-6140

Investor Contact:

Matt Glover or Tom Colton

AEYE@gatewayir.com

(949) 574-3860

-Financial Tables to Follow-

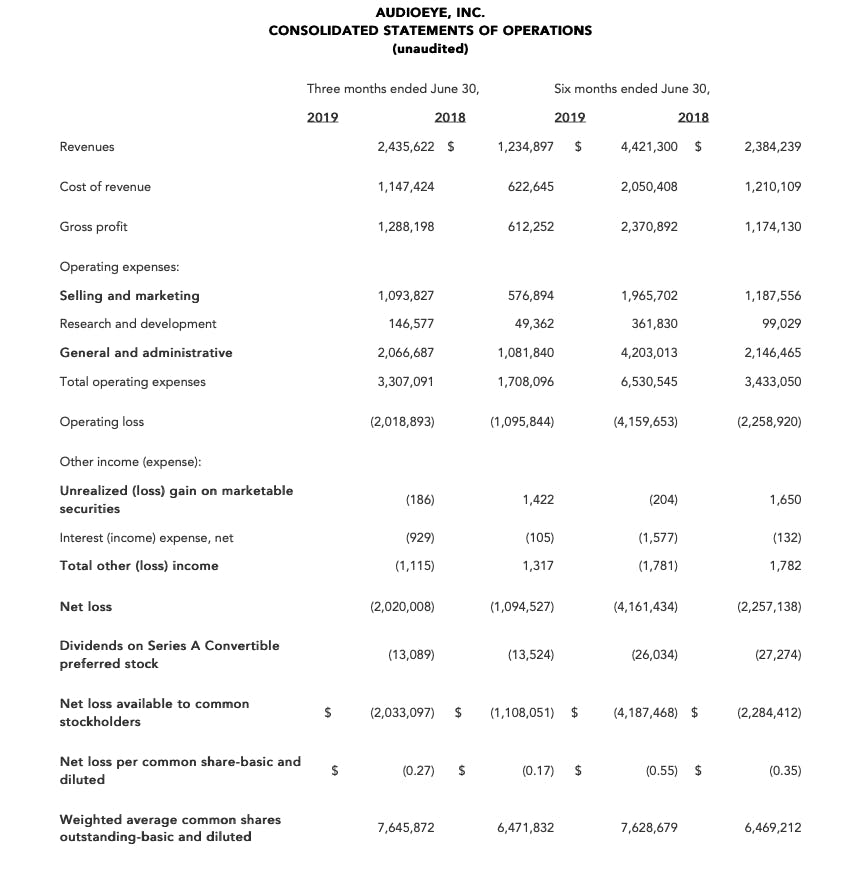

| Three months ended June 30, | Six months ended June 30, | |||

|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | |

| Revenues | 2,435,622 | $ 1,234,897 | $ 4,421,300 | $ 2,384,239 |

| Cost of revenue | 1,147,424 | 622,645 | 2,050,408 | 1,210,109 |

| Gross profit | 1,288,198 | 612,252 | 2,370,892 | 1,174,130 |

| Operating expenses: | ||||

| Selling and marketing | 1,093,827 | 576,894 | 1,965,702 | 1,187,556 |

| Research and development | 146,577 | 49,362 | 361,830 | 99,029 |

| General and administrative | 2,066,687 | 1,081,840 | 4,203,013 | 2,146,465 |

| Total operating expenses | 3,307,091 | 1,708,096 | 6,530,545 | 3,433,050 |

| Operating loss | (2,018,893) | (1,095,844) | (4,159,653) | (2,258,920) |

| Other income (expense): | ||||

| Unrealized (loss) gain on marketable securities | (186) | 1,422 | (204) | 1,650 |

| Interest (income) expense, net | (929) | (105) | (1,577) | (132) |

| Total other (loss) income | (1,115) | 1,317 | (1,781) | 1,782 |

| Net loss | (2,020,008) | (1,094,527) | (4,161,434) | (2,257,138) |

| Dividends on Series A Convertible preferred stock | (13,089) | (13,524) | (26,034) | (27,274) |

| Net loss available to common stockholders | $ (2,033,097) | $ (1,108,051) | $ (4,187,468) | $ (2,284,412) |

| Net loss per common share-basic and diluted | $ (0.27) | $ (0.17) | $ (0.55) | $ (0.35) |

| Weighted average common shares outstanding-basic and diluted | 7,645,872 | 6,471,832 | 7,628,679 | 6,469,212 |

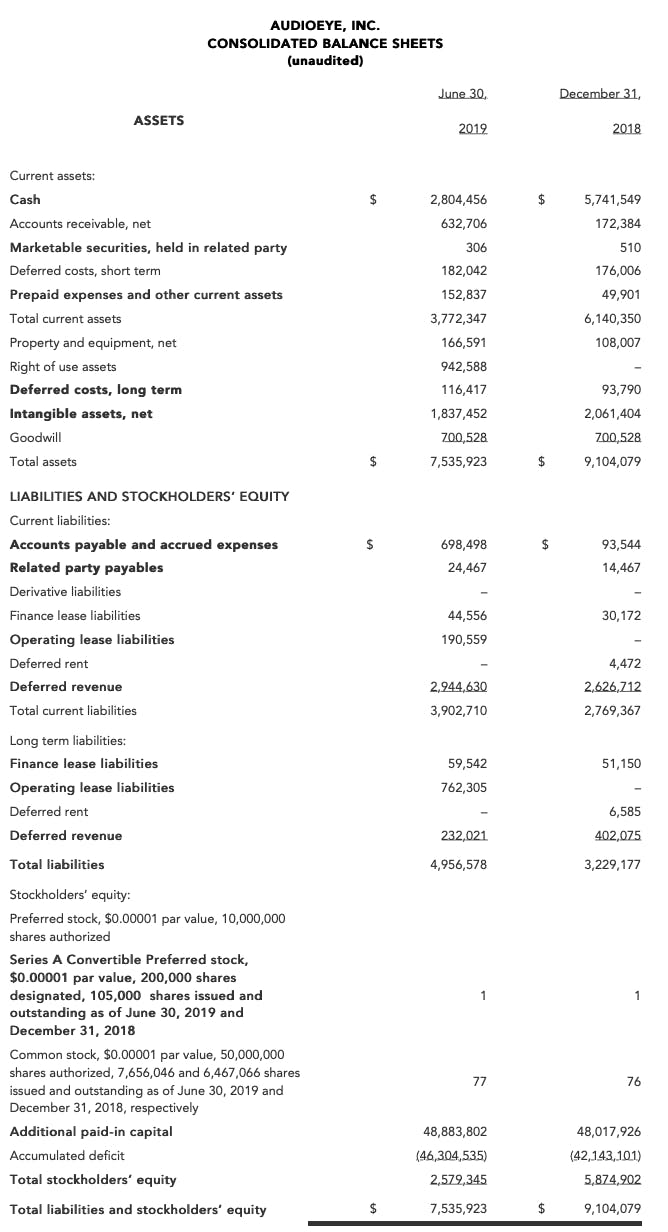

| ASSETS | June 30,

2019 |

December 31,

2018 |

|---|---|---|

| Current assets: | ||

| Cash | $ 2,804,456 | $ 5,741,549 |

| Accounts receivable, net | 632,706 | 172,384 |

| Marketable securities, held in related party | 306 | 510 |

| Deferred costs, short term | 182,042 | 176,006 |

| Prepaid expenses and other current assets | 152,837 | 49,901 |

| Total current assets | 3,772,347 | 6,140,350 |

| Property and equipment, net | 166,591 | 108,007 |

| Right of use assets | 942,588 | – |

| Deferred costs, long term | 116,417 | 93,790 |

| Intangible assets, net | 1,837,452 | 2,061,404 |

| Goodwill | 700,528 | 700,528 |

| Total assets | $ 7,535,923 | $ 9,104,079 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||

| Current liabilities: | ||

| Accounts payable and accrued expenses | $ 698,498 | $ 93,544 |

| Related party payables | 24,467 | 14,467 |

| Derivative liabilities | – | – |

| Finance lease liabilities | 44,556 | 30,172 |

| Operating lease liabilities | 190,559 | – |

| Deferred rent | – | 4,472 |

| Deferred revenue | 2,944,630 | 2,626,712 |

| Total current liabilities | 3,902,710 | 2,769,367 |

| Long term liabilities: | ||

| Finance lease liabilities | 59,542 | 51,150 |

| Operating lease liabilities | 762,305 | – |

| Deferred rent | – | 6,585 |

| Deferred revenue | 232,021 | 402,075 |

| Total liabilities | 4,956,578 | 3,229,177 |

| Stockholders’ equity: | ||

| Preferred stock, $0.00001 par value, 10,000,000 shares authorized | ||

| Series A Convertible Preferred stock, $0.00001 par value, 200,000 shares designated, 105,000 shares issued and outstanding as of June 30, 2019 and December 31, 2018 | 1 | 1 |

| Common stock, $0.00001 par value, 50,000,000 shares authorized, 7,656,046 and 6,467,066 shares issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | 77 | 76 |

| Additional paid-in capital | 48,883,802 | 48,017,926 |

| Accumulated deficit | (46,304,535) | (42,143,101) |

| Total stockholders’ equity | 2,579,345 | 5,874,902 |

| Total liabilities and stockholders’ equity | $ 7,535,923 | $ 9,104,079 |

Ready to see AudioEye in action?

Watch Demo

Ready to test your website for accessibility?

Share post